Call for Posters

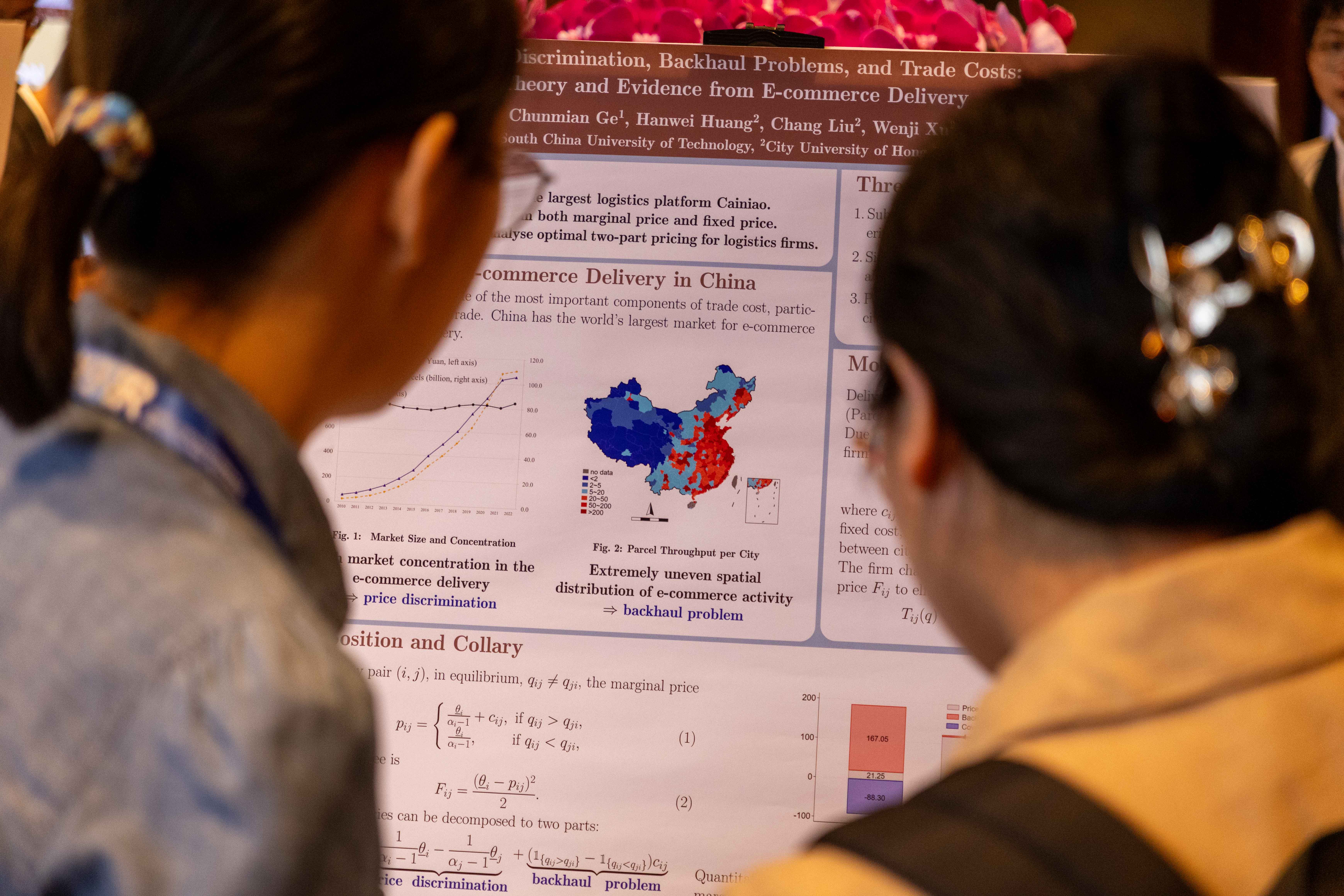

The Asian Bureau of Finance and Economic Research will be holding its 12th Annual Conference on 19-22 May 2025 at Conrad Singapore Orchard. We now invite submission of high quality papers from PhD students for the poster sessions which will be held on 20 and 21 May 2025. [Submission closed. View accepted posters here]

Topics of Interest

- International Macroeconomics, Money & Banking

- Corporate Finance

- Investment Finance

- Trade, Growth and Development

- Accounting

- Real Estate and Urban Economics

- Household Finance

- Sustainable and Green Finance

- Labour Economics

- Tech, Digital Markets and AI

For International Macroeconomics, Money & Banking, we are interested in a variety of topics, including (but not limited to): central banking, exchange rates, financial crises, financial risk management, foreign direct investment, international capital flows, macroeconomic policy, monetary and fiscal policy, prudential regulation, systemic risk and other international macroeconomics and money and banking topics, particularly those of relevance to Asia.

For Corporate Finance, we are interested in topics relevant to Asian firms, markets, or regulators - even if Asian data are not used. Past years' presentations have explored behavioral corporate finance, business groups, capital investment, capital structure, comparative corporate finance, corporate governance, dividends, financial development, law and finance, mergers and acquisitions, multinationals, ownership structure, tunneling, corporate innovation, fintech, climate risk, and other areas of research.

For Investment Finance, we are interested in a variety of topics, including, but not limited to: asset price fluctuations, asset allocation, behavioural finance, financial market microstructure, market efficiency, portfolio management, market timing, sovereign wealth funds, behaviour investment finance, financial technology, and all other investment finance topics relevant to Asia.

For Trade, Growth and Development, we will consider any paper under this general theme, which is broadly interpreted. For example, interesting papers related to labor, financial markets, political economy and structural transformation in developing countries will also be considered. We welcome both applied theory and empirical papers.

For Accounting, topics including but not limited to: the determinants and consequences of managers’ corporate financial reporting and disclosure decisions; the role of accounting information within organizations, including compensation; external auditing; the role of accounting in corporate governance; the effect of taxes on management decisions; the role of regulation in accounting and auditing practice. Ideally papers address these issues using data drawn from the Asia Pacific region or having direct relevance for this region.

Real Estate is closely intertwined with the disciplines of macroeconomics, investment finance, and household finance. It welcomes submissions of theoretical, empirical, and policy research in real estate finance, housing and urban economics, which include, but are not limited to, housing price and housing affordability; sustainable development issues; discrimination, disparities, and diversity in housing and real estate markets (e.g., mortgage lending, residential development); climate risks and real estate asset market implications; finance green and sustainable development; household finance; securitization and real estate capital markets; commercial real estate finance and investment; PERE and REITs; etc.

Household Finance encompasses topics on (1) how households make financial decisions relating to the functions of saving, consumption, investment, housing, payment, borrowing and risk management, (2) how organizations provide products and services to satisfy these financial functions, and (3) how interventions by firms, governments and other parties affect the provision of financial services. The scope of household finance spans multi disciplines, embracing not just finance and economics but also industrial organization, law, psychology and sociology. We welcome both applied and theoretical papers in this area.

Sustainable and Green Finance encompasses various topics related to how sustainability has become an important issue for companies, investors, financial intermediaries, and capital markets. Climate change and the corresponding regulatory initiatives and frameworks pose serious challenges for commercial operations in many industry sectors, and consequently financial intermediaries and capital markets. Understanding the sustainability of businesses and industries in this dynamic environment is vital for financial entities in order to assess and efficiently price these exposures. Innovations in green finance can also play a role in enhancing the sustainability of commercial operations. The development in sustainable and green finance relies on various disciplines beyond finance and economics, including natural sciences, law, geography, design, engineering, and computing. We welcome both applied and theoretical papers in this area.

For Labour Economics, we are interested in labour-related topics, including, but not limited to issues related to employment, labour in the global economy, workplace health and safety, and other labour trends (e.g. an ageing and multi-generational workforce, gender, skills-based employment, mental well-being at work, technology bifurcation, and hybrid work). We especially welcome papers with public policy relevance.

For Tech, Digital Markets and AI, we are interested in research that explores the transformative impact of digital technologies and artificial intelligence on innovation, science and research, productivity, labor markets, competition, finance, and management systems. Topics of interest include the economics of AI and Web3, AI for social sciences, AI-driven decision-making, foundational models, AI ethics, copyrights, and alignment, FinTech, blockchain applications, crypto assets, decentralized finance, the data economy, digital platforms, digital finance, digital privacy, and tech innovations. We welcome papers that advance fundamental research in economics, finance, and other fields, offering actionable insights for practitioners, addressing regulatory challenges, or applying and customizing emerging technologies in these fields, or analyzing their socioeconomic implications. Contributions that combine theoretical frameworks with empirical analysis, create interdisciplinary knowledge, bear relevance for Asian economies, or provide novel methodologies are particularly encouraged.

Timeline

| Open Submission | 15 November 2024 |

|---|---|

| Submission Deadline | 15 January 2025 |

| Selection by | 15 February 2025 |

| Inform Authors by | 28 February 2025 |

Things to Note

- We highly encourage submissions from PhD students and those who are not affiliated with ABFER.

- Submissions can be a joint work with other scholars, researchers and PhD students. PhD students are also welcomed to submit their working papers to the conference Call for Papers.

- Presenter has to be a current PhD student.

- The presenter has to bring the roll-up poster, set up and attend the poster sessions in-person on 20 and 21 May at 5:00 pm.

- The selection committee will select 10 to 16 papers. Authors have to prepare the poster if their papers are selected. Guidelines on poster preparation will be provided.

- The selection committee will award three prizes after the poster sessions.

- Best poster: S$500

- 1 st Runner-up: S$300

- 2 nd Runner-up: S$200

- Only selected authors will be notified and decision by the selection committee is final.

Interest to Attend

- If you are interested to attend the conference, please visit this page.

Organising and Selection Committee

Chair: Jun PAN (Shanghai Jiao Tong University)

Allen HUANG (The Hong Kong University of Science and Technology)

Kwan Ok LEE (National University of Singapore)

Kenichi UEDA (University of Tokyo)